In a winter season where Mother Nature and labor relations collided, Park City’s vacation rental market faced a December that tested the resilience of even the most seasoned property managers.

📅 Date Range

- 12/1/2024 – 12/31/2024 vs 12/1/2023 – 12/31/2023

🔎 Key Takeaways

Seasonal Trend

- The snowpark for December was at a 30-year low.

- Park City’s Ski Patrol Union went on strike Friday, December 20th; right at the start of the busiest time of the year. This had an effect on future reservations.

Market Insights:

- December 2024 saw a 241% increase in occupancy compared to November 2024.

- All metrics were down compared to the previous year.

Overview

December 2024 presented unprecedented challenges for Park City’s vacation rental market, with a historic 30-year low snowpack setting the stage for a difficult holiday season. The situation was further complicated by the Park City Ski Patrol Union strike beginning December 20th, which coincided with the traditionally bustling holiday period. These extraordinary circumstances created significant headwinds for property performance metrics across the board.

Occupancy

Occupancy

The challenging conditions led to a notable decline in occupancy rates, dropping from 32.9% in December 2023 to 30.4% in December 2024, representing a 7.6% year-over-year decrease as travelers responded to the uncertain conditions.

- 2024: 30.4%

- 2023: 32.9%

- Decrease: ⬇️ 7.6%

Park City Occupancy December 2024 vs December 2023.

💲 ADR

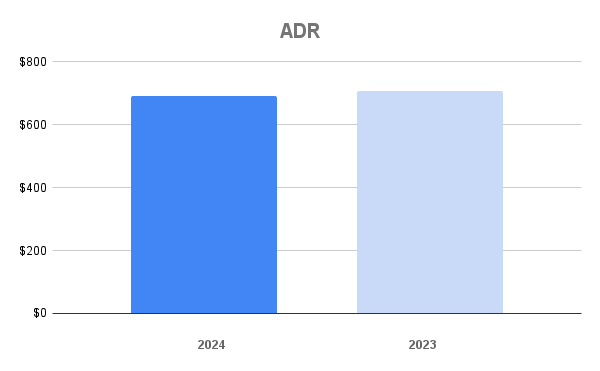

Average Daily Rate (ADR) faced downward pressure in response to the market challenges, decreasing by 1.84% from $706 in 2023 to $693 in 2024, reflecting property managers’ efforts to maintain booking momentum in a compromised market environment.

- 2024: $693

- 2023: $706

- Decrease: ⬇️ 1.84%

Park City ADR December 2024 vs December 2023.

+💲 RevPAR

+💲 RevPAR

The combined impact of lower occupancy and reduced rates resulted in Revenue per Available Room (RevPAR) declining by 9.05% year-over-year, falling from $232 in 2023 to $211 in 2024, highlighting the substantial effect of these unique market conditions on overall revenue performance.

- 2024: $211

- 2023: $232

- Decrease: ⬇️ 9.05%

Park City RevPAR December 2024 vs December 2023.

Conclusion

The December 2024 performance metrics underscore the vulnerability of seasonal vacation markets to external factors beyond property managers’ control. While the historic low snowpack created an initial challenge, the addition of the ski patrol strike during the crucial holiday period amplified the impact on property performance. Despite these significant headwinds, property managers demonstrated strategic adaptability in their pricing approaches, working to minimize revenue impacts while navigating these extraordinary circumstances. This experience highlights the importance of robust revenue management strategies that respond effectively to unexpected market disruptions.

Compare this to the November 2024 vacation rental statistics.

Park City Property Management

If you’re struggling to maximize your Park City property’s potential and seeking expert guidance to optimize your vacation rental performance, contact our team today for a comprehensive, data-driven evaluation that can transform your revenue management strategy.

Dataset

The data set is based on 61 property managers with 3,200 properties with 0, 1, 2, 3, and 4 bedrooms. The report covers key neighborhoods such as Bear Hollow, Canyons Village, Deer Valley, Jordanelle, Kimball Junction, Old Town, Prospector, and Thaynes Canyon, providing insights into occupancy rates, average daily rates, and revenue per available room within these regions.

![Your Guide To Park City Mountain Lift Tickets [2024-2025] Your Guide To Park City Mountain Lift Tickets [2024-2025]](https://www.allseasonsresortlodging.com/wp-content/uploads/2023/09/ski-slope-from-lift_1024x1440-1.jpg)